2018 February Newsletter

It's February and while the hot weather continues it's back to business for most of us, with summer holidays, tennis and cricket over for another year. This is a perfect time to revisit your New Year's resolutions and put all your good intentions to work for the remainder of 2018.

For the first time in a decade all the world’s top economies are growing. The International Monetary Fund (IMF) forecasts the global economy will expand 3.9 per cent in 2018, the fastest rate in eight years, up from 3.7 per cent last year. US growth is expected to reach 2.9 per cent this year on the back of tax cuts. The Eurozone, Japan and some emerging economies such as Brazil are also tipped to gather steam this year.

The forecast for Australia is unchanged at 2.9 per cent. On the upside, local jobs grew for the 15th straight month in December although the unemployment rate rose from 5.4 per cent to 5.5 per cent as more people entered the market. Retail sales were up 1.2 per cent in November, or 2.9 per cent over 12 months, and consumer confidence remains high. After hitting a 4-year high mid-January, the weekly ANZ/Roy Morgan consumer confidence index dipped 3.3 per cent as a potential NSW rail strike and power blackouts in some states dampened spirits, before lifting 1.3 per cent in the final week to 120.9, well above the long-term average. The Australian dollar rose from US76.5c mid-December to above US81c in January, which no doubt pleased Aussie travellers.

Golden Rules of Investing

At first glance, investing can seem daunting. So much complex information and so little time to absorb and act on it when you’re busy getting on with life. It’s little wonder that so many of us put it in the too hard basket for longer than is good for our wealth. At first glance, investing can seem daunting. So much complex information and so little time to absorb and act on it when you’re busy getting on with life. It’s little wonder that so many of us put it in the too hard basket for longer than is good for our wealth.

The good news is that investing doesn’t need to be hard. The basic rules of investing are surprisingly simple and timeless.

Set your objectives

If you want to reach your personal and financial objectives, first you must define what they are.

Ask yourself where you want to be in 5, 10, 20 years’ time. Be specific, put some dollar figures beside each goal and then start planning how you will get there.

We can assist you in your goal setting and in mapping out a strategy to achieve your goals.

The genius of compounding

Albert Einstein said compound interest was man’s most powerful discovery, but it doesn’t take a genius to put it into practice. Compound interest means you not only receive interest on the money you invest but interest on your interest. Over time, this simple concept becomes a powerful wealth creation tool.

Say you invest $10,000 today at 5 per cent; with all interest reinvested, it will grow to $27,126 in 20 years. Now look what happens if you spend your interest payments, earning what is called simple interest. Your $10,000 will earn $500 a year and will be worth just $20,000 in 20 years.

That’s the genius of Australia’s superannuation system which locks away your savings and all investment earnings until you retire.

Take your time

We all know we should take an active interest in our super and other investments, but is there such a thing as too much interest? Yes, according to a study by US fund manager, Fidelity Investments. A review of clients over a decade found the best performing accounts were for investors who were dead! Next best were investors who had forgotten they had accounts. The thing both groups had in common was that they were not actively trying to time the market.

A landmark study of 66,000 investors by the University of California reached a similar conclusion. The most active investors underperformed the overall sharemarket return by 6.5 per cent a year, leading the researchers to conclude trading is hazardous to your wealth.

The lesson is, be patient and stick to your plan.

Reduce risk with diversification

Shares, property, bonds and cash all have good years and bad. Even though shares and property provide the best growth in the long-term, prices can fall or move sideways for years at a time and you don’t want to be forced to sell in a downturn because you need the cash.

The way to reduce the risk of crystallising losses or losing everything on one dud investment is to diversify across and within asset classes. The right mix will depend on the timing of your goals and your risk tolerance. Think about investments that provide capital growth in the long run and income when you need it – from bank deposits, bonds, share dividends or rental income from investment property.

Follow the cycle, not the herd

When you take a long-term perspective, and have clear investment goals, it’s easier to sit back and watch market cycles unfold. Then when you see an opportunity to buy quality assets at a low price, or sell an investment that no longer meets your objectives at a high one, you can pounce.

Investors who panicked during the GFC and switched out of shares into cash and bonds would have done better to sit tight and ride out the volatility. And investors who took the opportunity to top up their holdings when the market was gripped by pessimism would have done even better.

Successful investing doesn’t need to be over-complicated. Give us a call to help map out a plan and let time, diversification, compound interest and our knowledge of the investment landscape do the rest.

i. http://theconservativeincomeinvestor.com/2015/05/26/fidelitys-best-investors-are-dead/

ii. http://faculty.haas.berkeley.edu/odean/papers%20current%20versions/individual_investor_performance_final.pdf

Transition to retirement still a smart move

They say 60 is the new 40. And while it’s true that today’s over-50s are healthy and active for longer than previous generations, many in this position begin to dream about scaling back their work commitments so they can start ticking off their bucket list.

You may want the flexibility to travel more, volunteer or take up a hobby. Perhaps you want to look after the grandkids for a day or two a week. It might be you see your 60s as an opportunity to switch careers or try your hand at freelance work or consulting where you control the amount of time you work. Services such as Airbnb and Uber are also providing opportunities to earn an income on your own terms.

Alternatively, you may have planned to retire early but now find you are not in a financial position to stop work completely. Your savings may have been adversely impacted by the GFC, divorce or remarriage or you may still have mortgage or other debts to repay.

Either way, there is a trend towards more people working well into their 60s and beyond but not necessarily full time. According to the Australian Bureau of Statistics, 56.9 percent of 60 to 64-year-olds are in the job market, while the percentage of those working over the age of 65 has jumped to a record high of 12.7 per cent.

Winding back the hours

One way to achieve a better work/life balance in the lead-up to retirement is to adopt a transition to retirement income stream (TRIS). Once you have reached your preservation age, which is currently at least 57 (depending on your date of birth), then you can access between 4 per cent and 10 per cent of your superannuation as an income stream. This will let you work fewer hours but maintain your standard of living.

Despite losing some of their tax advantages on July 1 last year, a TRIS strategy still holds its appeal for people who want to use it as it was originally intended – to aid in the transition to retirement.

In the past no tax was payable on earnings from your TRIS investments; now you will be taxed at 15 per cent. But the favourable tax treatment of withdrawals remains the same. Once you reach 60, any monies withdrawn from your TRIS pension are tax free. For those aged 56 to 60, you will pay tax at your marginal rate but then enjoy a 15 per cent offset.

Boost your super

Another change to the super legislation is that you can only contribute a maximum of $25,000 a year as salary sacrifice regardless of your age. As a result, there may not be so much money beyond your employer’s Superannuation Guarantee contributions that you can add to your super to fully take advantage of the scheme.iii Even so, if you salary sacrifice as close to this limit as possible, you will help boost your super for when you do completely retire.

Despite these changes, a transition to retirement strategy can still work for you, largely because super continues to be one of the most tax-effective investment environments for your retirement savings.

Supplementing part-time income with a TRIS might also give you an opportunity to reduce your mortgage or other debts before you leave the workforce completely.

A win-win solution

Easing your way out of work can be as good for you financially as it is for you psychologically. To go cold turkey from working one day to retirement the next can be difficult without careful planning.

Working out what to do in the run up to retirement needs careful consideration. We can help you decide what will work best for you.

i ‘Older Australians working longer’, Commsec Insights, 23 November 2017.

ii https://www.ato.gov.au/Individuals/Super/Super-changes/Change-to-transition-to-retirement-income-streams/

iii https://www.ato.gov.au/super/self-managed-super-funds/contributions-and-rollovers/contribution-caps

Monthly Fund Profile : Pengana Australian Equities Fund

What does it invest in?

The Pengana Australian Equities Fund invests in a concentrated portfolio of ASX listed securities. It owns stocks with a transparent business model, competent management that are trading at a reasonable price relative to the cash flow generated by the business.

The Fund’s current top positions are Credit Corp, ANZ, ResMed, CSL and Westpac. The Fund also holds over 20% in cash as at 31 December 2017.

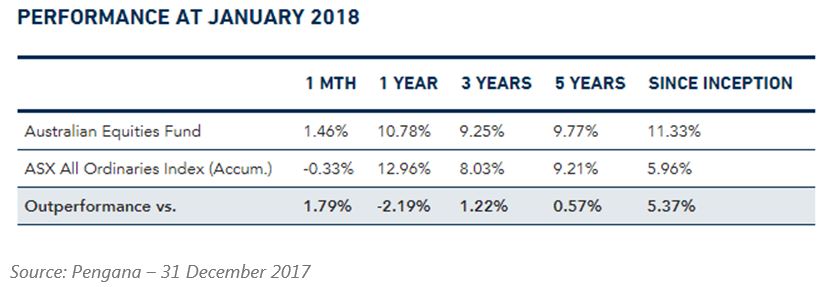

What is its performance?

The performance of the Pengana Australian Equities Fund has been strong as evident by its longer term track record of 3 years, 5 years and since inception (July 2008) performance figures. The Fund also has the characteristic of slightly underperforming the benchmark during strong bull markets while materially outperforming the benchmark during market downturns. This is much to do with its stock selection process (high quality, strong cash flow companies) and the fact that it would often hold cash to buy into opportunities during market weakness.

Potential benefits to your portfolio

The Pengana Australian Equities Fund has a low level of volatility of 9.4% since inception which compares favourably with the ASX 200 Accumulation Index’s volatility of 11.0% during the same period. When constructed with other Australian equities fund, Pengana’s lower volatility often results in a smoother return when compared to the market.

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

EFDB Pty Ltd | Sydney CBD | Northern Beaches | ABN 64 112 871 922 | AFSL 311720

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)