2016 October Newsletter

October is upon us and it’s the closing stages of the battle for the US Presidency that is keeping markets on the edge of their seats.

Global markets have had a volatile few months in the run up to the November 8 US Presidential election. Risk assets have been on the rise, with gold up around 26 per cent this year and the Aussie dollar up from a low of US68.58c in January to levels above US76c in September. The rising popularity of the more protectionist Donald Trump, and the trend towards protectionism in Britain and elsewhere, has coincided with a marked slowdown in global trade. The World Trade Organisation has cut its forecast for global trade growth this year from 2.8 per cent in April to 1.7 per cent, lagging growth in the world economy for the first time in 15 years. Commentators suggest a Hillary Clinton victory would result in a smoother ride for global markets. Hence, her relatively strong performance in the first Presidential debate in the last week of September produced a bounce in US shares and the US dollar and pullback in gold.

Affluenza - are you afflicted?

These days, spending a lot of money on things is considered unremarkable at worst. It’s a sign that we’re becoming comfortable with a certain level of buying that our grandparents would have considered absurd. Where once an average person would never borrow money, or would only borrow to buy their home, it’s now normal to take on debt to enjoy a lavish holiday, buy shiny new appliances, or pick up the latest season’s fashion.

What is Affluenza?

‘Affluenza’ is a term first used as early as the ‘50s, but popularised in the late ‘90s. A portmanteau of ‘influenza’ and ‘affluence’, there are no prizes for guessing its meaning. Prominent anti-consumerist authors Naylor, Wann and de Graaf define it as “a painful, contagious, socially transmitted condition of overload, debt, anxiety, and waste resulting from the dogged pursuit of more.”i In other words, it’s the way individuals, and society as a whole, are conditioned to always want more stuff. We’re taught that buying the latest, biggest and best this or that will solve whatever problem we feel we have – whether it’s a real problem, or one manufactured by the marketing industry. It’s a darker and more complex take on the old idiom ‘keeping up with the Joneses’.

Take a break from shopping ‘til you drop

Hundreds of coordinated campaigns around the world aim to combat affluenza in its different forms. One such campaign is Buy Nothing New Month – October each year. Founded in Melbourne, it’s now spread as far as the Netherlands.ii A few UK and US families have taken it further, buying nothing for a whole year, and documenting their experiences along the way.iii The most widely celebrated (perhaps because of its ease) event is Buy Nothing Day.

Australia’s Buy Nothing coordinators say their movement is about taking the time to ask yourself questions such as:

- Do I really need this?

- Can I rent or borrow it instead?

- Can I get this second hand, perhaps online or from an op shop?

- Could I swap with a neighbour or someone in my community?

- What resources went in to producing this, and is there a better alternative?

Change your habits

There are certainly practical and financial benefits of not buying anything new. Those who’ve embarked on the aforementioned shopping-free experiments have described saving thousands of dollars – often without feeling like they’re going without or doing it tough. Most authors have also described retaining their newfound thrifty habits after their experiment was over, saving them extra in the long term as well. One popular frugality blogger summed it by saying “Every frugal tip in the world isn't going to save as much money as simply not buying anything.”iv

Reap the benefits

Anti-consumerist advocates tout a variety of non-monetary advantages, including learning financial discipline, creative thinking when it comes to meeting your needs, and getting back in touch with your personal values.

Committing to buying nothing new might sound intimidating. Especially when it’s for a whole month. Going without new non-essentials for that long takes a lot of discipline and planning. If that’s not your thing, you might want to consider Buy Nothing New Month as an opportunity to start thinking about how you’re spending your money. Think about whether you’re stretching your income as far as you can – and whether you mightn’t be better off putting some of that spending money into savings or investments.

i de Graaf, Wann and Naylor, Affluenza: The All-Consuming Epidemic, Berrett-Koehler Publishers, 2001

ii Buy Nothing New Australia

iii Buy Nothing Year

iv Frugalwoods| Advant Plus

Super gets a makeover again

Despite this, the reforms still represent significant alterations to the current superannuation system. Assuming the changes are legislated, retirement savers will need to ensure they are swimming between the new flags from 1 July 2017.

New $1.6 million limit on tax-free super

One of the major reforms is the introduction of an indexed $1.6 million limit on the total amount of accumulated super an individual can transfer into the tax-free retirement phase. Earnings on that balance will not be capped, but any savings above $1.6 million must remain in an accumulation account (where earnings are taxed at 15 per cent), or be moved out of the super system to avoid penalty taxes.

Cut to concessional contribution limits

An important change for many people will be the reduced annual caps on the amount of concessional (before-tax) contributions they can make into their super account. From 1 July 2017, the annual cap on concessional contributions will be a flat $25,000 (indexed). This is down from the current limits of $30,000 for those aged under 50 and $35,000 for those aged 50 and over.

High income earners will also need to watch the new lower $250,000 income threshold, as their concessional contributions become taxable at 30 per cent, compared to 15 per cent normally.

Lower annual non-concessional (after-tax) contributions cap

The controversial $500,000 lifetime non-concessional contributions cap has been replaced with an annual cap of $100,000 (down from the current $180,000). Individuals aged under 65 will still be eligible to bring forward three years of non-concessional contributions, while those aged between 65 and 74 can now make non-concessional contributions if they meet a work test.

To help pay for replacing the $500,000 lifetime limit with a lower $100,000 annual cap, individuals with a super balance of over $1.6 million will be ineligible to make non-concessional contributions.

Tax deductions for personal contributions

Many super savers will benefit from new rules allowing additional people to claim a tax deduction for their personal contributions into super. From 1 July 2017, individuals aged under 65 and those aged 65 to 74 who meet a work test will be able to claim a tax deduction.

Catch-up contributions delayed

Individuals planning to make ‘catch-up’ contributions into their super will have to wait a little longer, as the proposed starting date for this reform has been deferred to 1 July 2018. Under the new rule, people with account balances below $500,000 will be able to rollover any unused concessional caps for up to five years.

New benefit for low income earners

From 1 July 2017, the Low Income Superannuation Contribution (LISC) will be replaced with a new Low Income Superannuation Tax Offset (LISTO). The LISTO will be a refund (up to $500) of the concessional contributions tax paid by individuals with income under $37,000.

Spouse tax offset expanded

More couples will be able to use the $540 tax offset for spouse contributions under the new rules, with the spouse income limit rising to $40,000.

Transition-to-retirement (TTR) pensions wound back

In contrast, TTR arrangements will be less attractive, as the tax-free status of income generated by the assets supporting these pensions is being removed. From 1 July 2017, this income will be taxed at 15 per cent and certain income stream payments will no longer be counted as lump sums for tax purposes.

The rules governing Australia’s super system are complex and with the many changes being passed through legislation it's challenging to stay up to date and ensure that your retirement planning takes into account these changes.

If you would like more information or just to chat about how super can be used to build your retirement nest egg, please contact our office today.

Source: http://treasury.gov.au/SuperReforms | Advant Plus

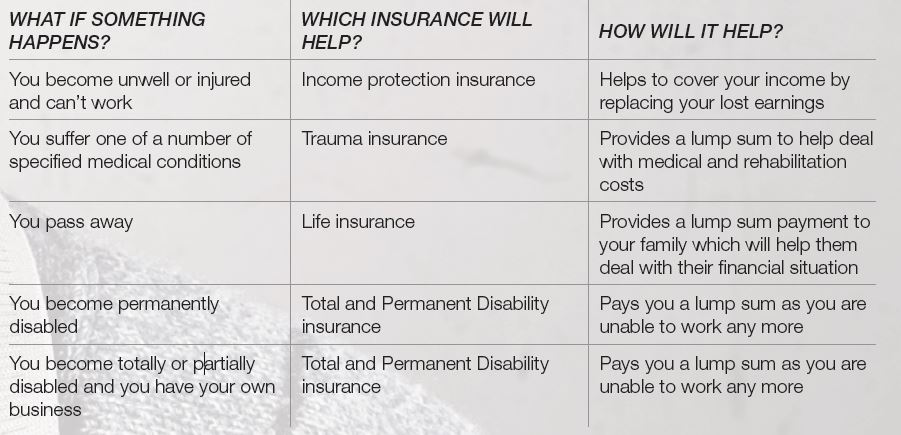

A Story About the Importance of Insurance

If you are like most Australians, insurance is one of those things which can be put off for another day. But another day might be one too late – the story of John outlines how important it is to have the right insurance.

John was a fit and healthy single 53 year old who had just started his own bookkeeping business. One weekend he was hosting a Christmas in July party where everyone was enjoying themselves. Later in the evening he started bumping into things and slurring his speech. Thinking he had drunk too much, his friends put him to bed. The next morning when he couldn’t get up he called an ambulance.

It turned out John had a stroke which was caused by bowel cancer. After fighting for his life for the first

couple of days, he started on the slow path to recovery which included chemotherapy, physiotherapy,

speech therapy and psychotherapy. He had multiple surgeries to remove the cancer and had limited use

of his left side.

During this already stressful time of dealing with health issues, John started having money problems.

Because he had just started up his business, he had limited savings. While he was in hospital there was no one to work in the business so he had no income coming in.

John did have trauma insurance, but he was not very good at maintaining the payments, so there was a

question as to whether he was eligible for disability payments. While his friends and family were trying to sort out his financial mess, the rent on John’s house became overdue. With no alternative, they had to

move his possessions into storage. They also had to close down his business.

Luckily John did have income protection insurance through his superannuation. He had opted for the 90

day waiting period which meant that although he didn’t get immediate help with his rent and bills, he was able to get a regular monthly income before he came out of rehabilitation hospital.

What did John learn?

The good news is that two years on, John is back working as an office manager for a small business. He is now cancer free and even with slight disabilities, he has a new lease on life.

Unfortunately hindsight is always 20/20, and looking back John wishes that he had put better insurance in place. As he couldn’t get sick pay from a regular full time job, he should have had insurance which could have filled the financial gap, which meant he could have kept renting his house.

Could you face a gap?

Most people don’t understand the need for the right insurance until a friend or family goes through a serious illness or death, when the reality of not having a safety net hits home. What will you or your family do if you can’t earn a living? Would you have enough money to cover the mortgage or the rent?

If you would like more information on how to plan for the future if the worst does occur, please contact our office today.

Source: Centrepoint Alliance, Prepare for Life | IOOF

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

EFDB Pty Ltd | Sydney CBD | Northern Beaches | ABN 64 112 871 922 | AFSL 311720

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)