2021 November Newsletter

It’s November and we started off with the race that stopped a nation. While this is normally a given, the fact that the Spring Carnival is going ahead, and overseas travel is back on the agenda, is a welcome sign that Australia is getting back to business.

All eyes were on the September quarter inflation figures in October, as speculation mounted that the Reserve Bank may be forced to raise interest rates sooner than planned. The Consumer Price Index (CPI) rose 0.8% in the September quarter while the annual rate eased from 3.8% to 3%, although this was distorted by the end of free childcare in the September quarter last year. A more accurate measure is underlying inflation, which rose to a 6-year high of 2.1% in the year to September.

Rising fuel and construction costs were the main culprits, as global supply chain disruptions pushed import prices up 6.4% over the year to September. Australia’s national average petrol price hit a record 169.5c a litre in October, as rising demand and supply constraints pushed the price of Brent Crude to a three year high. Inflation fears lifted the Australian dollar to US75.2c, up 4% over the month, while the interest rate on 3-year Australian government bonds lifted 82 basis points over the month to 1.14%.

Inflation fears also dented consumer confidence in the final week of October, but the ANZ-Roy Morgan rating still ended the month higher at 106.8. Rising business optimism saw the NAB business confidence index lift from -5.5 to +13 points in September.

We are unlikely to get a clear picture on inflation until supply pressures ease. The Reserve Bank has stated it won’t lift rates until inflation is ‘’sustainably” within its 2-3% target band and wages growth is above 3%.

Cyber security - protecting yourself at home

Greater flexibility in working arrangements has been a by-product of the pandemic, as working from home has become more widespread. In fact, The Families in Australia Survey: Towards COVID Normal reported in November 2020 that two thirds of Aussies were working from home.

Greater flexibility in working arrangements has been a by-product of the pandemic, as working from home has become more widespread. In fact, The Families in Australia Survey: Towards COVID Normal reported in November 2020 that two thirds of Aussies were working from home.While this flexibility has many benefits, it does also bring downsides, such as the increase in cyber security risks. With working from home to continue to be a reality for many, as workplaces move to more flexible working arrangements, here’s what we can do to stay safe.

Why cyber security is of greater risk at home

According to the ACSC Annual Cyber Threat Report 2020-21, there was an increase in the average severity and impact of reported cyber security incidents, with nearly half categorised as substantial. And there were over 67,500 cybercrime reports, an increase of nearly 13% from the previous financial year.Not only are cyber security attacks impactful to the individual, but they also take a toll on businesses. The Australian Cyber Security Centre (ACSC) found that the total estimated cost of cyber security incidents to Australian businesses is $29 billion per year.i

With so many Australians working from home, it’s no coincidence that the rates of cyber security attacks are on the rise. When we work from home, we are no longer protected by a closed office network, so we are at greater risk of cyber security threats.

Given we tend to be working alone at home, this also makes us more vulnerable to scams and phishing attempts. Click on a suspect email in the office, and it’s either caught before it gets to you or you can ask a co-worker if they have received the same. With fewer opportunities for water cooler chat, you are more likely to be out of the loop.

How to stay safe

There are various ways you can protect yourself from cyber-attacks, and you don’t need to be an IT whiz to do so.Install antivirus and security software

Your first layer of protection should be the use of antivirus and security software, such as Norton or Bitdefender. If you already have this software installed, ensure that it is up to date.Update software, including all security updates

You also want to stay up to date with your software, so don’t skip those security updates that appear on your computer and phone. You can turn on automatic updates, so you don’t have to worry about missing these.Secure your home Wi-Fi

As well as having a secure password for your home Wi-Fi, you should also use a strong encryption protocol for your router (currently WPA2 is the most secure type of encryption) – you can check this through your device settings.Review and update your passwords

If you have had the same password for years and don’t have variations for different purposes, it’s worth updating your passwords. It sounds obvious, but don’t choose a password that will be easy to guess, such as something relating to your street name or workplace.Opt for multi-factor authentication

Multi-factor authentication provides an extra layer of security when it comes to accessing your devices, making them harder to hack into. An example of multi-factor authentication is the combined use of a secure password, an item such as a security key or token, and a validation such as a SMS or email.Be aware of scams

Scamwatch.gov.au is regularly updated with the latest scams. Run by the ACCC, this website contains comprehensive and current information on scam attempts such as phishing and extortion. Share this info with family and friends so they also know what to be on the alert for.Consult with your IT Department

If your workplace has an IT Department, contact them to ask for any additional tips on how you can stay secure working from home.i https://www.cyber.gov.au/acsc/view-all-content/news/announcing-acsc-small-business-survey-report

Retirement income on the house

asset – your home.

asset – your home.With property prices booming, many retirees are finding that the home they have lived in for decades is worth a small fortune, but for various reasons they don’t wish to sell or downsize.

What many may not realise is that you can have your cake and eat it too. Or, in this case, convert part of the value of your home into an income stream while you remain living there.

The ability to borrow against the equity in your home without having to repay until you move out or sell comes in various guises, but the result is largely the same – an enhanced lifestyle in retirement. The extra income may allow you to enjoy some little luxuries, travel more, or pay for home improvements.

There are four key types of product on offer:

- Reverse mortgage

- Home reversion

- Equity release agreement

- The government’s Pension Loans Scheme (PLS).i

As a result, we recommend you speak to us first to discuss whether accessing some of your home equity would be appropriate for you.

This is how these products work:

1. Reverse mortgage

A reverse mortgage lets you borrow money against the value of your home and take it as an income stream, a line of credit, a lump sum or a combination.The amount you borrow is often determined by age. At 60 you can generally borrow 15-20 per cent of the value of your home. This percentage increases by 1 per cent a year.ii

The interest accrues and is paid when you sell, either on entering an aged care facility or from your estate when you die. The interest rate is usually higher than the standard mortgage rate, but you don’t have to make repayments along the way. Since 2012, reverse mortgages must come with a negative equity guarantee. This ensures you can never end up owing more than your home is worth.

2. Home reversion

Here you sell a percentage of the future value of your property at a reduced rate. It is not a loan, so there is no interest payable. However, there are immediate costs such as a property valuation and an upfront fee. And there is also the cost of losing the full benefit of your home’s increase in value over time. The more your home’s value increases, the more the provider will receive.3. Equity release scheme

This third option lets you sell a percentage of the value of your home in return for a lump sum or an income stream. You pay fees which are periodically deducted from the remaining equity in your home, so your share diminishes over time.ii4. Pension Loans Scheme

The Federal Government’s loan scheme is offered through Services Australia and the Department of Veterans Affairs.You can access a voluntary non-taxable fortnightly loan up to 150 per cent of the maximum Age Pension rate to bolster your retirement income with the loan secured against your home. You don’t need to be on the Age Pension to qualify but even if you are, this government loan does not impact your pension entitlements.iv

Your mortgage increases by the payment amount plus interest which currently stands at 4.5 per cent a year. As with the other schemes, you don’t need to repay the loan until you move out or sell. And if your circumstances change, you can adjust the loan accordingly such as pausing payments.

All four options are variations on a theme of providing a better lifestyle in retirement.

If you want to find out if any of these options might play a role in your retirement income strategy, don’t hesitate to call us to discuss.

Case study

Self-funded retirees Frank (75) and Mary (73) were struggling to maintain their lifestyle after no longer qualifying for the Age Pension. By borrowing $400 a fortnight against their $390,000 home from the government’s Pension Loans Scheme, they would still own 72 per cent of their property after 10 years and 41 per cent after 20 years. In the meantime, they can enjoy a few extra luxuries in life while remaining in their home. vi https://moneysmart.gov.au/retirement-income/reverse-mortgage-and-home-equity-release

ii https://www.ratecity.com.au/home-loans/articles/maximum-amount-borrow-reverse-mortgage

iii https://moneysmart.gov.au/retirement-income/reverse-mortgage-and-home-equity-release

iv https://www.pensionboost.com.au/faqs

v https://www.pensionboost.com.au/pension-loan-scheme

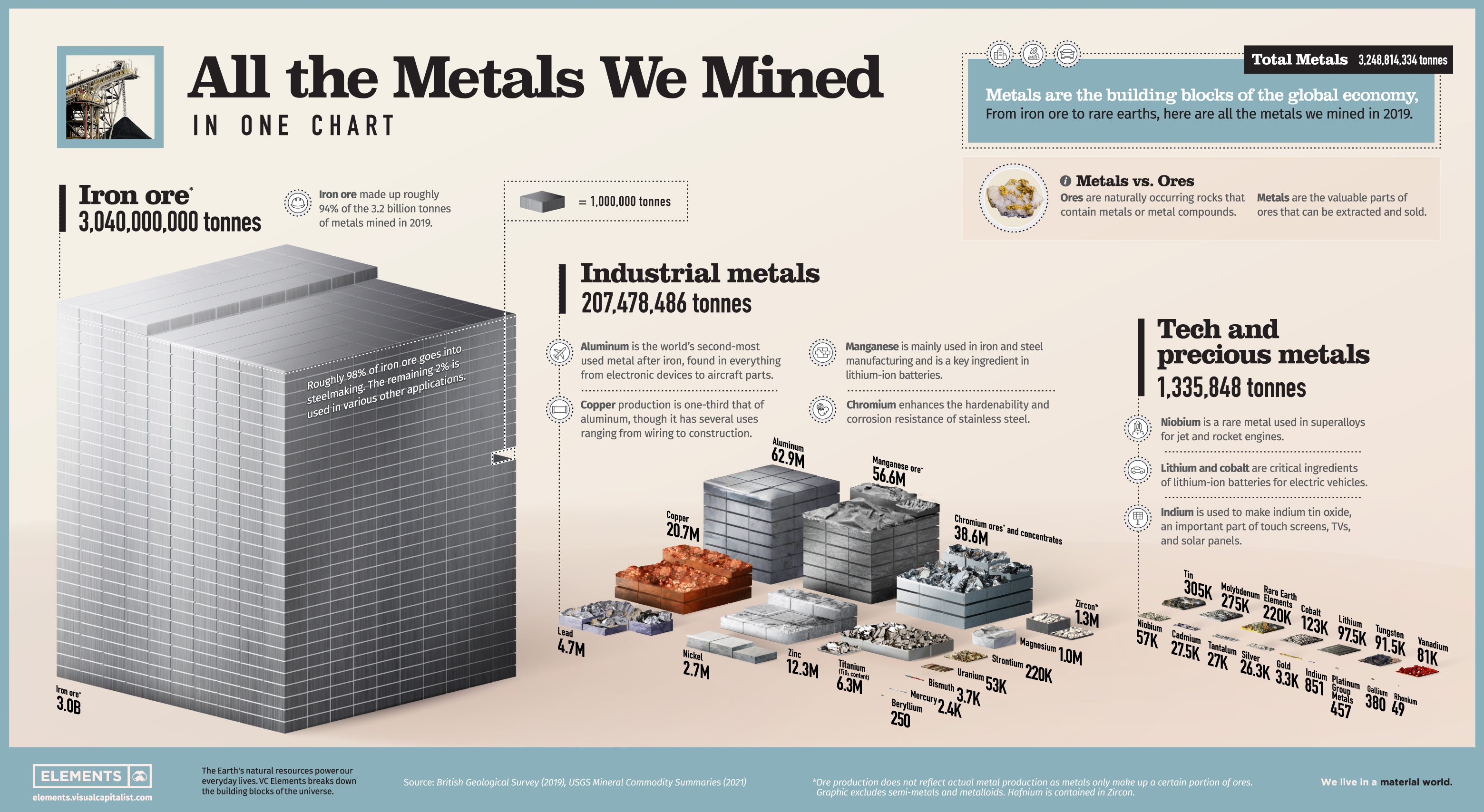

All the Metals We Mined in One Visualization

Please click here to read the article "All the Metals We Mined in One Visualisation".

Source: https://www.visualcapitalist.com/all-the-metals-we-mined-in-one-visualization/

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)