2016 September Newsletter

Federal Government announces contribution changes

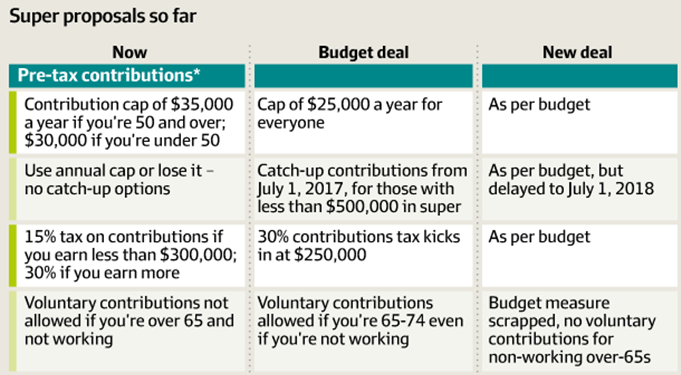

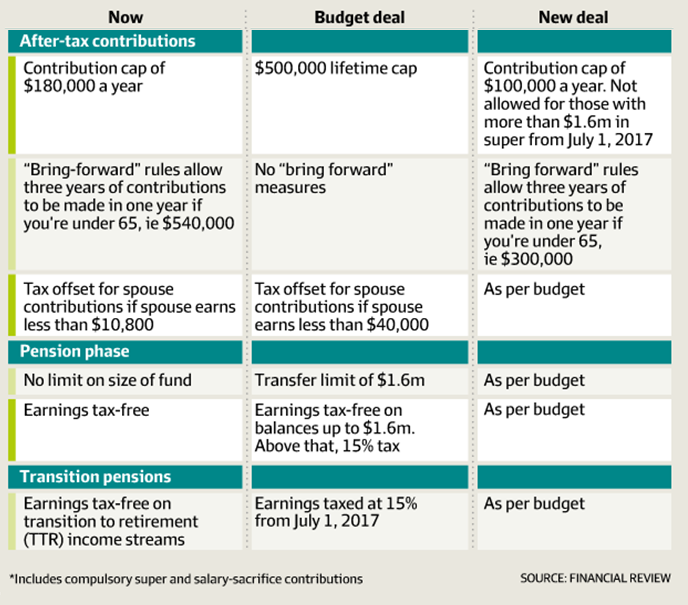

The Government has announced significant changes to the proposed superannuation reforms that were originally outlined in the 2016 Federal Budget in May, providing clarity and certainty for financial planners and clients around Superannuation.

We have provided below a table summarising the proposed changes to the initial budget announced in May this year. These changes have been proposed, but are yet to be legislated. Perhaps the most important proposed change for retirees is the introduction of the $1.6 m super cap and the reductions in the amount of money you can put into your super.

We have sourced the following table from the AFR as a quick reference guide to these new changes.

We are constantly monitoring the development and we will advise our clients accordingly as further details become available.

If you would like to speak to your adviser about how these changes may impact your personal situation, please feel free to pick up the phone and call us on 02 9223 0911. One of our friendly staff will put you straight through to one of our professional advisors, Ben, Jack, Jeremy, Vikram, Stuart or Elise.

Ethical Investing: From Backwater to Mainstream

Today’s consumers are increasingly demanding to know if their morning coffee is ‘fair trade’, their crispy-skinned fish is sustainably caught and their home can be run more efficiently on solar power. So it’s not surprising that many consumers are also choosing to align their ethics with their money.

Over the last decade, ethical investing has gone from backwater to mainstream. The amount of money invested in ethical funds – sometimes called sustainable or socially responsible investments – rose 62 per cent in the year to December 2015, to $51.5 billion.

The sector has also grown in relative terms, doubling over the past two years to 3.8 per cent of total assets under management. This was the finding of the Responsible Investment Benchmark Report 2016, an annual survey now in its 15th year.

But when it comes to investing your hard-earned cash, the feel good factor is not enough. In order to achieve your long-term financial goals, you need to earn the best possible return on your money.

Many happy returns

The numbers are in and they show that professionally-managed ethical funds have been performing strongly. Ethical Australian share funds and balanced (or multi-sector) funds have outperformed their benchmark index and comparable mainstream funds over 1, 3, 5 and 10 years. Ethical global share funds have outperformed over 5 and 10 years but not in the short term.

Of course, past returns can’t be relied on to predict future performance. But the figures do support the notion that it’s possible to invest responsibly without sacrificing returns.

What is an ethical investment?

The definition of ethical comes down to your personal values and can be as broad or narrow as you want it to be. You may want to support the development of renewable energy while others might want to limit the spread of poker machines. Or you may want mainstream fund managers to encourage high standards of corporate governance from the companies they invest in.

Here is a summary of investment styles on offer:

- ESG integration – includes environmental, social and governance (ESG) factors into financial analysis and investment decision-making by fund managers. This is done in the belief that these factors drive returns and reduce risk.

- Impact investing – targets investments aimed at social or environmental issues while creating positive returns for investors.

- Negative screening – excludes specific industries, sectors, companies, practices or countries that don’t align with ethical goals. Common exclusions are gaming, alcohol, tobacco, weapons and animal testing.

- Positive screening – selects investments with positive ESG or sustainability performance relative to industry peers. Sometimes called best-in-class screening.

- Sustainability – targets investments in areas such as clean energy, green technology sustainable agriculture and forestry, green property or water technology.i

Investing for the long term

It’s not just consumers who are driving ethical investing. Increasingly, professional investment managers are incorporating factors such as ESG practices into their mainstream investment products. And they are doing so for hard-headed financial reasons.

A recent US study found that 90 per cent of professional investors believe there is a link between corporate sustainability and long-term financial performance. According to managed fund ratings group Morningstar, a good ESG rating can be an indicator that a company is thinking seriously about the long term. This makes them a good fit for long-term investors and superannuation funds.

Nine out of 10 of Australia’s largest asset managers have taken broad ethical principles on board.

How can I invest ethically?

The simplest way to put your money where your values lie is to select an ethical managed fund or investment option either inside or outside super. This will provide a diversified portfolio of investments even if you have only a relatively small sum to invest.

Ethical investing has come a long way from a standing start back in the 1990s. If you would like to include an ethical component in your investment portfolio, give us a call.

i Responsible Investment Association of Australia

Budget your way into the Black

$2.2 trillion. That’s how much Australian households owe right now, according to the latest ABS stats.i Household liabilities grew by $1.2 billion in the last quarter alone. Real household debt per person has risen steadily by around 2 per cent per year, and now sits at around $79,000 per person.ii

$2.2 trillion. That’s how much Australian households owe right now, according to the latest ABS stats.i Household liabilities grew by $1.2 billion in the last quarter alone. Real household debt per person has risen steadily by around 2 per cent per year, and now sits at around $79,000 per person.ii

Sound scary? The good news is, there are ways you and your family can buck this trend and ensure your finances stay out of the red and in the black. The key is good old fashioned budgeting.

Why a budget is important

Budgeting is simply the most straightforward, proactive way to ensure you will always have enough money for the things you need whilst allowing you to put a little aside for the things at the top of your wish list. That’s the practical side of it. A budget can also help you reduce financial stress, improve your family relationships, redefine your personal values, and provide a good example for your kids or grandkids.

How to set up a budget

The first step is to do an audit of what you’re spending. You may also need to do a round-up of what you’re earning, if you have several income streams. Start by gathering as much evidence as possible; utility bills, receipts, bank statements etc. Make a tally of your outgoings. Be as accurate as you can; where you don’t have a record to substantiate a line item, try not to underestimate it.

Then, compare your income to your outgoings. If you spend more than you earn, you’ve got work to do. If you’ve got a surplus, that’s a great start, but there’s always room for improvement.

The second step is setting goals. Choosing well defined goals – beyond just ‘save more’ or ‘get rich’ – is important for your long-term budgeting success. Try setting at least a few short, mid and long term goals. For example, in the short term, you might aim to reduce your spend on clothing by $100 a month. In the long term, you could aim to build up an emergency fund equivalent to six months’ household income.

Why budgets fail

If all this sounds familiar to you, chances are you’ve tried and not succeeded at budgeting in the past. That doesn’t necessarily mean you’re ‘bad with numbers’ or lacking discipline. There are several common reasons why budgets don't stick. Many failed budgets had no defined goals. Others were too restrictive, allowing no room for spending on things like meals out or entertainment; anyone who’s tried to completely cut ‘fun’ spending knows how unrealistic this is. Many budgets also ‘break’ after a short time because they fail to account for unexpected emergency expenses, from vet bills to urgent travel.

Once you’re aware of why your last budget didn’t succeed, you can start to build a better one.

The right technology can help make your budget more accurate, realistic, effective, and easy to stick to. You don’t even have to create a spreadsheet from scratch, or use complicated software on your PC. Carry a budgeting solution in your pocket with a handy smartphone app:

Budgeting apps to make it easier

1. ASIC MoneySmart’s TrackMyGoals and TrackMySpend apps – FREE

These government-produced apps draw on tonnes of research to help you implement proven savings and budgeting strategies.

2. Pocketbook – FREE

Pocketbook syncs with your bank account, automatically sorts your expenses into categories, and receive automatic alerts and warnings to keep you on track.

3. You Need a Budget – US$5/month or US$50/year

In the case of YNAB, one of the world’s most popular budgeting apps, it’s a case of spending money to save money. According to their stats, the average user saves US$200 in their first month using the app, and US$3,300 in their first nine months – that’s over $4,300 Aussie dollars.

Still need a bit of help creating a budget, getting your expenses under control, or increasing the rate at which you save? We’re here to help. Give us a call today to discuss your household budget situation.

i ABS, 5232.0 - Australian National Accounts: Finance and Wealth, Mar 2016

ii ABS, 4102.0 – Australian Social Trends, 2014 (Final): Trends in Household Debt

Diamond Blue Office Fitbit Challenge

We have seen a significant change in staff’s attitude to health and wellness. They are more empowered and inspired to lead healthier, more active lives while engaging in fun competition. Thanks to fitness device trackers (i.e. Fitbit) which allow Diamond Blue employees share and compete with fellow colleagues and clients on the number of steps made each week.

If you want to know more about possibly decreasing your risk insurance premiums while increasing wellness, please feel free to pick up the phone and call us on 02 9223 0911. One of our friendly staff will put you straight through to our risk specialist, Dianna Pecherczyk.

Please click here to access the PDF version of our September 2016 newsletter.

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

EFDB Pty Ltd | Sydney CBD | Northern Beaches | ABN 64 112 871 922 | AFSL 311720

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)